In the end of 2019 the European Commission introduced the official communication called the European Green Deal. The document consists of official aims which leads the EU to create coherent, sustainable economics with 90% reduction of GHG emissions in transport till 2050. This will be possible mainly by introducing the new emission standard—Euro 7 which start is scheduled after 2025. Currently, most of the automotive industry insists that new standard leads to phase off diesel engines in heavy transport. This means that last mile operations will require transition from standard diesel tractor units up to low emission and zero emission vehicles.

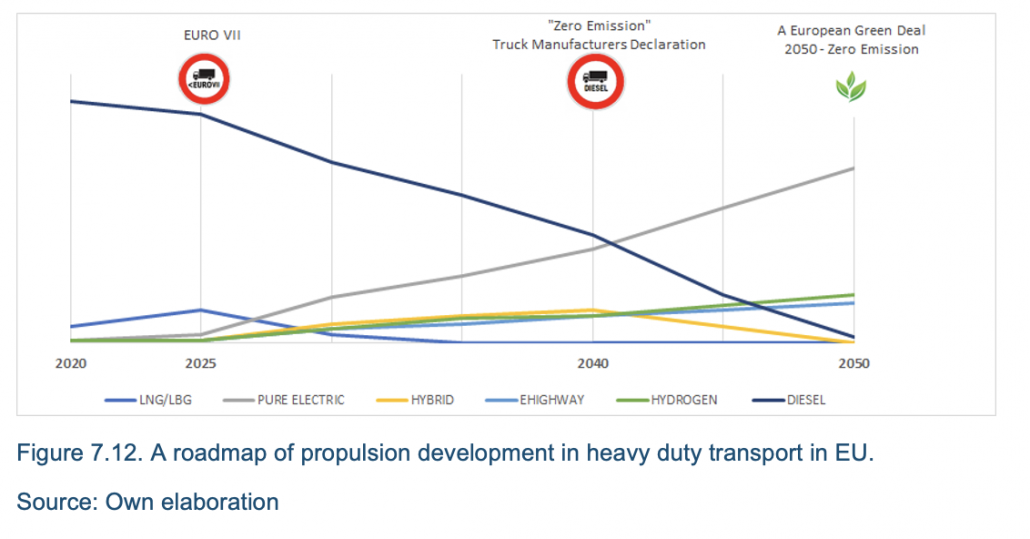

Based on the above incentives, manufacturers are developing various powertrains which most of them are on early stages of production or tests so the market availability is limited. Thus, it is hard to clearly indicate its suitability for CT operations and especially economic effects. The subject of this chapter indicates only solutions which are based on author’s choice has at the moment the biggest change to develop and be used in future CT operations (Figure 7.8).

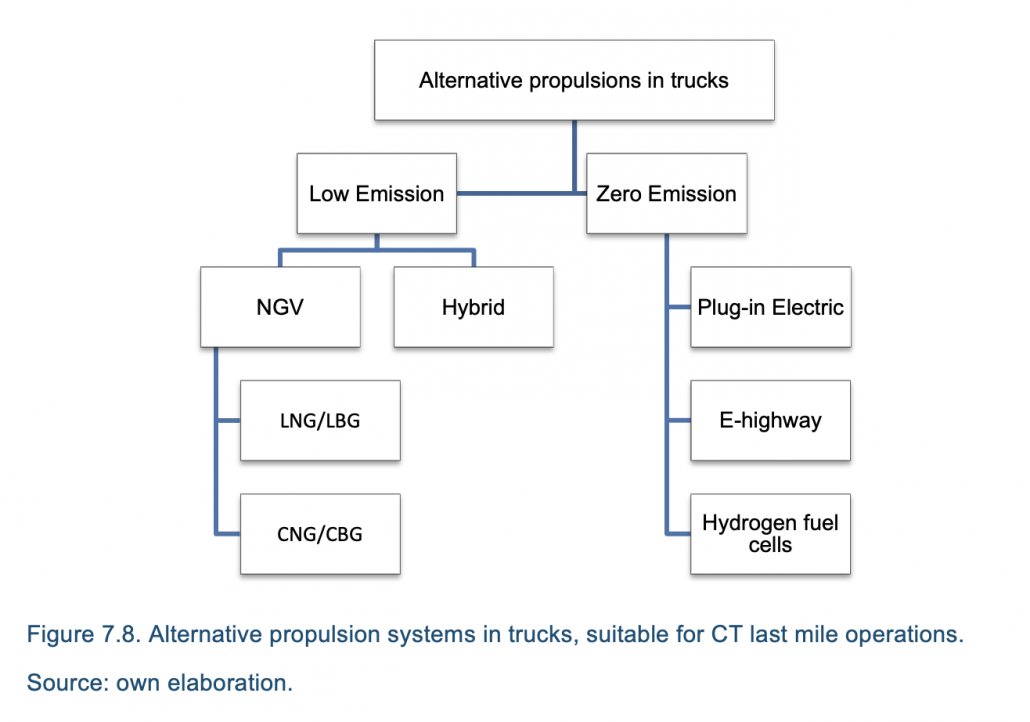

Medium (above 3.5 t.) and heavy haulage fleet in the EU consist on approx. 6.5 mln vehicles. Above 1/3 of them are registered in BSR, mainly in Poland and Germany. The average fleet growth in region is leveled at 2.7% y/y which is a bit above the EU average—2.31%. The biggest fleet growth can be noticed in Poland (4.16%) and Lithuania (7.37%) (ACEA, 2020).

The European medium and heavy haulage fleet mainly consists of diesel-powered vehicles with 98% of trucks in the EU equipped with diesel engines. Rest propulsions play a marginal role, and their share in the EU do not exceed 1% per kind of propulsion. Hybrid and electric vehicles actually do not exist in European goods transport. The registrations of this kind of trucks is noticed on in a few countries which can even mean that trucks are registered as a test or demo trucks for manufacturer or dealer.

BSR do not surpass much of the overall EU statistically (Table 7.4). Due to unclear statistics in Poland, BSR average of diesel is lowered, but based on observations, much of unknown number should be considered as diesel trucks. In the coming years, it is expected a rise in the number of LNG propelled trucks both in the EU and BSR is expected. Main reasons for such a perspective is a relatively good availability of this technology and government support for LNG fleet development. This gives opportunity for a fast market response to future CO2 emission limits (ACEA, 2020).

7.3.1 CNG/LNG/LBG/CBG

Technology description

The increasing number of vehicles and limited worldwide resources of crude oil gave another ignition position on the development of alternative propulsions. One of the most popular LEV technologies, which now is relatively widely developed is using natural gas to propel the vehicles called natural gas vehicles (NGV), referred to as Methane (CH4). It still is considered a fossil fuel, but is still a good alternative for diesel fueled vehicles.

There are two main types of trucks propelled with natural gas: LNG and CNG.

LNG which is abbreviation of Liquified Natural Gas is a fuel resultant from the methane cooled and stored at the temperature -160oC. Such low temperature allows to shrink the volume of methane and change physical state to liquid. Low temperature requires to use proper cryogenic tanks to store the fuel in the trucks. To keep the safety, special tanks are equipped with valves which allows to deploy the gas which increase the volume due to rising temperature. The combustion process may be conducted with pure LNG or mixture of LNG with diesel, then the vehicles are referred to dual fuel engines.

LNG trucks are in general recommended for long and heavy haulage. The reason for this application is longer range in comparison with CNG or electric propelled vehicles. The manufacturers of LNG tractors declares its range up to 1,000 km with engine which generates up to 460 HP which is also sufficient for heavy haulage up to 40 or 44 tonnes.

CNG as the abbreviation from compressed natural gas refers to the vehicles equipped fueled with compressed methane. The compression of methane is possible due to cylinder tanks installed on vehicles. Tanks allows to fill up and store methane compressed up to 21 to 25 MPa.

The biggest disadvantage of CNG trucks is the limited range. For example, Iveco, for their latest generation of CNG tractor units set the maximum range between 400-500 km depending on engine and tanks configuration. The other disadvantage of this technology is the diversified fueling time. Depending on station efficiency we can diversify “slow fueling stations” where total time for tractor units is considered between 5-7 hours, and fast fueling sites, where the process last maximum 20-25 minutes.

LNG/CNG vehicles for CT operations – market availability

Market research arranged at the beginning of 2020 shows three main suppliers of CNG/LNG trucks across Europe and the BSR which are Scania, Volvo, and Iveco. All of them offer wide range of axle configurations and cabin sizes. The well-developed supply side of the market is a prove that LNG/CNG is the most available alternative propulsion for trucks. Most of the dealers offer them in regular sales, not only based on bespoken orders. However, the widest offer can be found in light and medium trucks for local distribution, which are not suitable for last mile in CT transport due to its comparatively low power, torque, or chassis configuration limited to rigid trucks. Below shortlist shows trucks are considered as suitable for CT operations. Optimal configuration for CT operation according to haulage companies and based on current EU directives was described as: tractor unit in 4×2 axle configuration for light ILU and 6×2 for 42-44 tonnes configuration. Engine power according to haulers experience should be considered at approx. 400 HP for light ILU, and above 500 HP for safe transport of heavy ILUs in 42-44 tonnes configuration.

On the other hand, it is important to notice that manufacturers like Daimler (Mercedes-Benz) or Paccar (DAF) declared that they are considering natural gas as short-term solution and they will not develop NGV technology. For those manufacturers future of truck propulsions belongs to electricity or hydrogen and their R&D activities focus on mentioned propulsions.

Fueling stations availability

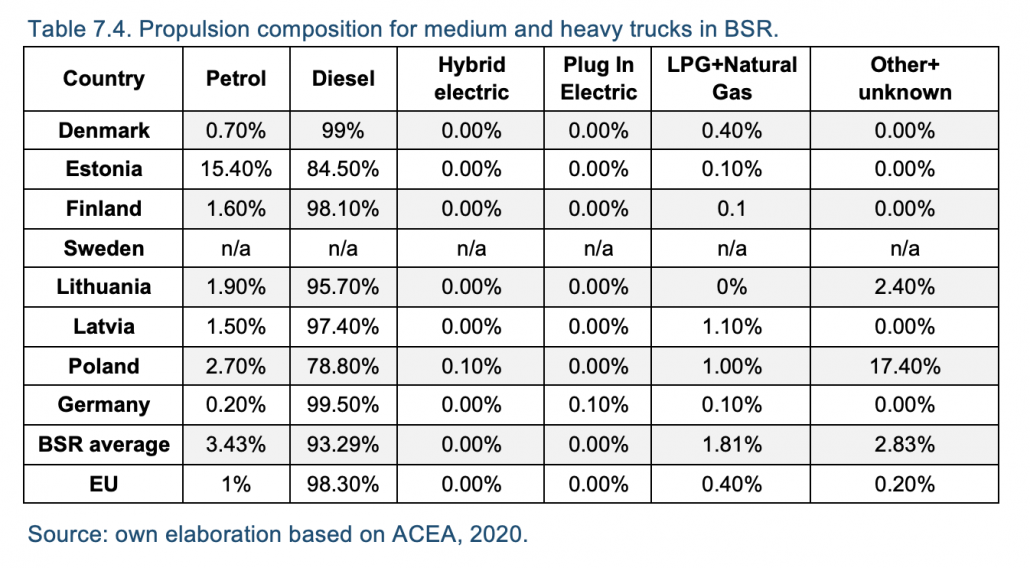

The increasing number of NGV’s requires well-covering network of fueling stations. At the beginning of 2020, there are 2.1 million registered NGV across Europe. Based on NGVA statistics only in 2019 in Europe registered almost 90,000 NGV vehicles among of 21,000 CNG and 45,000 LNG trucks. The same association forecasts that in the next 10 years the total number of registered NGV vehicles in Europe will grow six-fold, reaching 13 million (NGVA, 2020).

The average number of CNG stations per 100 km of highway in the EU area do not exceed three. BSR shows bigger availability of such fuels. Drivers can fill up CNG six times on each 100 km of highway. The biggest density to road network shows Estonia and Sweden, approx. 10 stations /100 km. The development of CNG stations network seems to grow stable year by year in whole EU countries and region. It’s developing mainly due to local municipalities, who invested in CNG vehicles such like buses or communal vehicles, i.e., dump trucks. What must be also underlined, a lot of the stations are built for purpose of municipalities and are not for the open public, or access requires additional agreements with station operators.

LNG filling locations show a much bigger dynamic for development. In last year, the number of locations across Europe increased almost 200%, mainly due to development of network in Germany. The average increase in BSR in last year also rise for almost 180%. Unfortunately, dynamic development seems to be still not sufficient for forecasted number of vehicles. As per research arranged by ACEA it should reach 750 fueling stations across EU by 2025 and 1,500 by 2035 (ACEA, 2020). In 2019, the total number of those sites did not exceed 400 (Figure 7.9). This means that average number of stations per 100 km highway in the EU and the BSR do not exceed 0.3 locations. If we take a look at each country, Finland is a leader when comparing LNG stations with motorways length. In average, there is a possibility to fill up LNG every 100 km of motorway in Finland. The density of stations per 1,000 km2 in the BSR is on average level of 0.03 and it is 1/3 of average density in the EU. What is important to say, there is still no fueling infrastructure available in three countries, i.e., Latvia, Lithuania, and Denmark (EAFO, 2020).

From the angle of CT last mile operations, it is important to install filling stations in the near radius of terminal—to keep fluent supply of NG to trucking companies. As an example of good practice, the station open in Vuosaari Port in Helsinki can be indicated (Figure 7.10).

LBG/CBG

LBG which is the abbreviation for “Liquified Bio Gas” is the alternative fuel for the fossil natural gas and LNG as fuel. Biogas is the product of the breakdown of organic matter in the absence of oxygen. This reaction is possible in the biogas plants which are commonly connected with sewage or waste plants to deliver raw, organic material for production.

The natural source of the biogas makes that it is considered as a renewable, non-fossil energy. It offers a huge potential for all the NG trucks. Although biogas in its first stage contains Hydrogen sulfide (H2S). This compound reacts with the machinery due to its corrosive nature, thus biogas needs to be upgraded and cleaned. Carbon dioxide, water, and particulates also must be removed from biogas composition before it will become biomethane which after cooling or compression can become Liquid biomethane as substitution for natural gas. Due to the high costs of biogas cleaning and upgrading, truck manufacturers spreads the researches to allow LNG/CNG vehicles to be filled up with biogas.

Germany is a main producer of biogas. In 2018 there were almost 11,000 launched plants in Germany. In the BSR, the second country is Poland with 308 plants and then Sweden with almost 200 locations (EBA, 2019). That gives a great potential to BSR to develop the fleet of eco-friendly trucks as the next step for development of gas-powered fleet.

IRR for LNG truck on CT operations

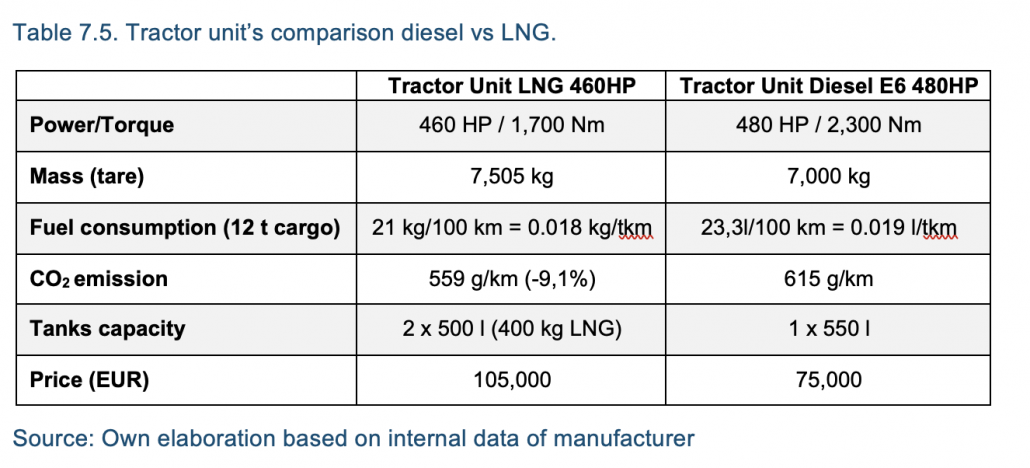

In the last few years a lot of road haulage companies decided to develop their fleet fueled with LNG tractor units. Most of those fleets are used for long haulage transport across Europe. In the opposite to long haulage CT last mile operations characterize more frequent transport on shorter distances. Such work conditions can make LNG equipment less economical efficient for this purpose. Table 7.5 shows general assumptions for calculating economic efficiency of LNG truck in CT last mile operations:

The comparison of diesel and LNG tractor parameters from same manufacturer with same chassis and cab configuration shows that LNG units are heavier by about 0.5 t compared to a diesel-powered unit. This aspect is crucial for CT operations. A heavier tractor leaves less space for cargo weight; thus, it gives another reason to consider implementing LHV in all BSR countries or at least give a legal space to increase the maximum allowed weight of truck/trailer combination.

What is more, LNG trucks are more expensive than its diesel equivalent. Depending on country markets and individual negotiations difference in price can exceed 30%.

If we consider upkeep costs between LNG and diesel truck on similar levels the decision of buying LNG truck should be considered only based on average monthly mileage and transported cargo weight with spread between diesel and LNG price in filling station.

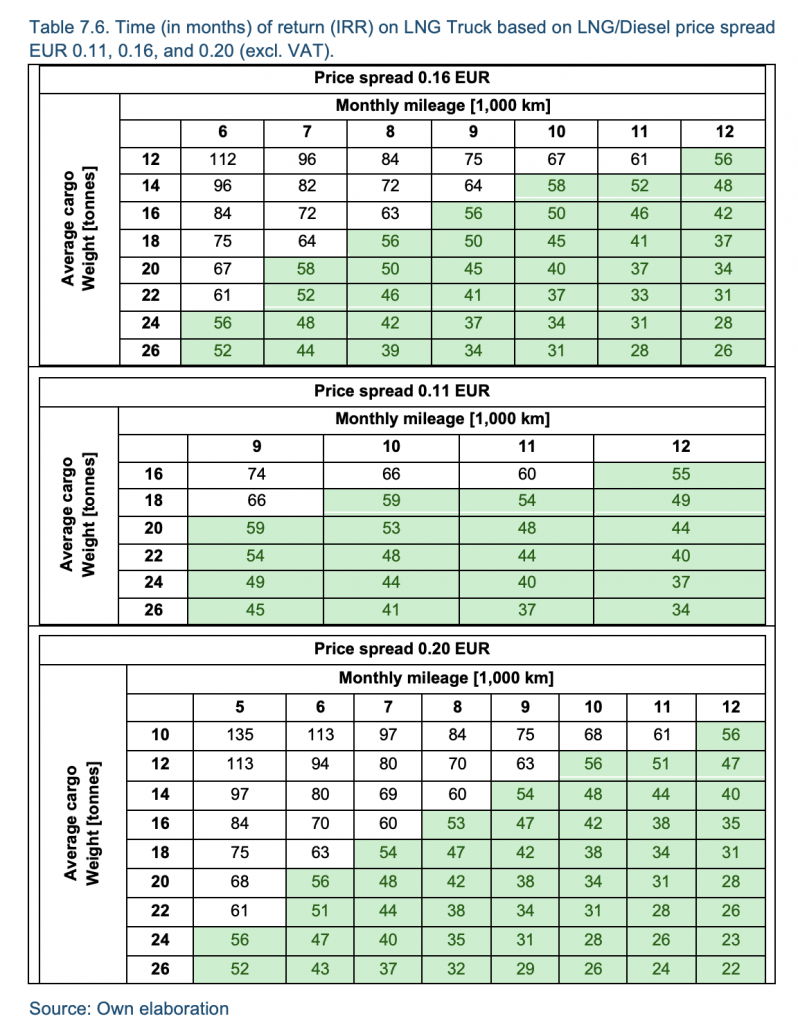

Table 7.6 shows the months of using LNG truck needed to get return in investment. Cells colored in green indicates time below five years which is considered as optimum time of operation for trucks. The bigger spread between prices, the faster return on investment is possible to get. The prices of the fuels are flexible in mentioned countries. At the beginning of 2020 average spread between LNG and Diesel price (excl. VAT) in the BSR was set at EUR 0.16.

As it is shown in Table 7.6, depending on all factors, IRR in LNG truck can be reached starting from two-three years. However, this can be achieved only if the equipment will be working on heavy loads on long distances. In CT operations the distance factor is strictly limited by the law to 150 km per one way. On the other hand, the limitation of monthly mileage is the working time of drivers. Taking into consideration the average last mile delivery at distance 50 km, trucker can perform even three roundtrips per day which can give average mileage 6,000 km monthly based on 20 workdays/month.

Trucking companies in the BSR that are considering investing to LNG trucks in CT operations shall strictly calculate expected workflow to keep the efficiency of investment. For many of them from the economic point of view LNG truck might be not the best solution due to specific of their last mile works.

In Germany, federal authorities launched a special support program for LNG/CNG vehicles. All the trucks propelled with CNG or LNG are exempted from toll on the roads. This was another argument for investment in the LNG fleet for many trucking companies, not only from Germany but also for all international long-distance truckers.

At the moment, Germany is the only country in the BSR which offers such benefits for the companies equipped in NGV vehicles. At the beginning of 2020 German government discussed if the program will be continued only till end 2020 or extended. One of the arguments was to support other alternative propulsions like hydrogen or electric which are considered as zero-emission vehicles. However, the authorities decided to prolong the LNG support program till the end of 2023 (IRU, 2020).

Market availability – trucks and charging stations

As it was said in previous paragraph, there are few manufacturers developing electric trucks on the European Market. E-trucks market can be divided into two groups of manufacturers. The first one includes biggest players like DAF or Volvo which announced to develop a full range of electric trucks by end 2021. The second group consists of small developers, i.e., Futuricum and Framo.

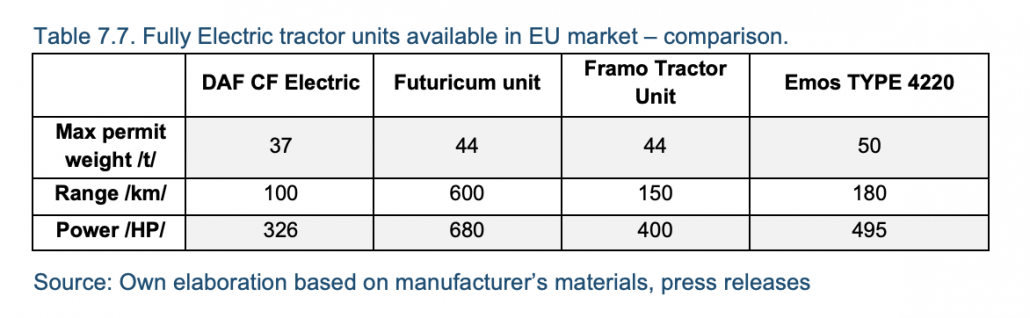

Taking into consideration CT-suitable trucks only, for the beginning of 2021 DAF is the only one from the “great 7” of trucks manufacturers who offer commercially fully electric tractor unit. Electric DAF CF configuration allows to build max 37 tonnes truck + trailer combination. Electric engine generates 286 HP, and it is supplied from 170 kWh battery which allows to drive up to 100 km between charging.

The next market competitor which is expected to launch a full electric tractor unit according to the last press release is Nikola which is a sister-company of Iveco. The vehicle Is planned to launch on the European market during 2020-2021. Nikola Tre will be an electric unit based on Iveco S-way. Truck configurations allow to get 500 km range with engine power 650 HP.

Although, at the moment the biggest development and availability of electric trucks takes place in small companies who are developing electric trucks based on common tractor units.

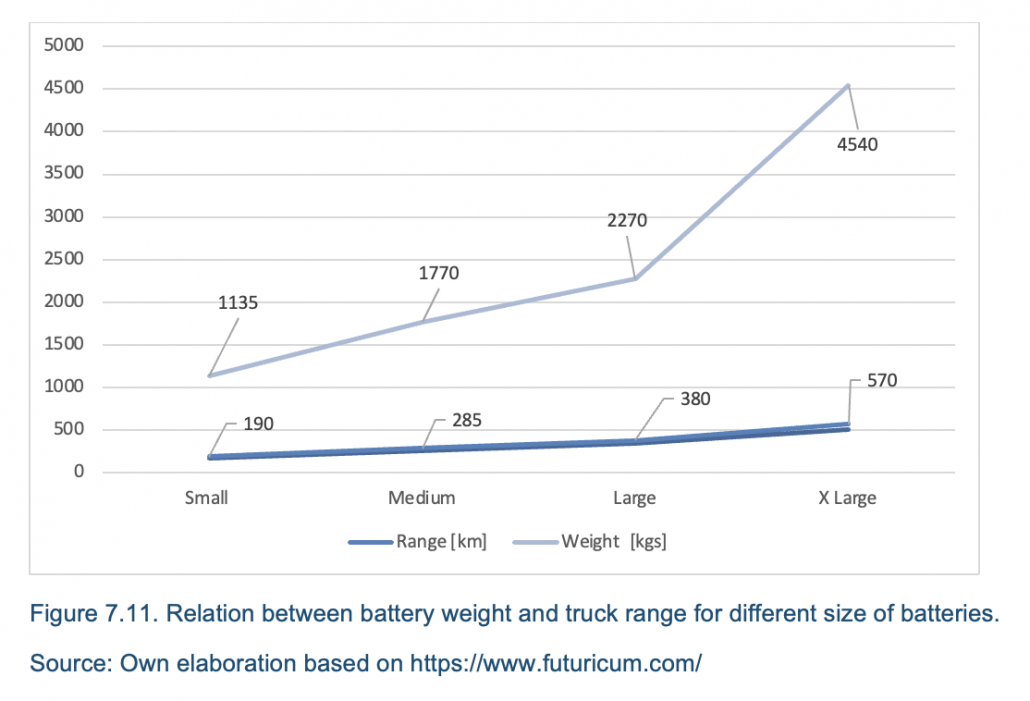

Trucks under brand Futuricum are manufactured and designed in Switzerland based on Volvo FM/FMX cabs. Those tractor units allow to get over 600 km range on single charging. Units are equipped with the electric engine which generates up to 680 HP.

Another example of “new-born” truck manufacturers or companies who offer electric vehicles is Framo. Units built by Framo in Germany are based on MAN TGX tractor units with an electric engine on board. It allows to build 44 tonnes combination with maximum range of 150 km. In 2019-2020 Framo trucks have been tested in CT operations under Dutch-German Interreg project eGLM, Electric Green Last Mile.

Despite the large number of projects underway, electric trucks are not widely available on the market as for diesel or NGV trucks. Sales network for small developers actually does not exist. Only DAF CF electric, Nikola Tre and Volvo electric trucks will be available in sales network of DAF and Iveco. Furthermore, also lead times for electric trucks which for now are truly custom-made products is much longer than diesel equivalents. One of the manufacturers declare lead time around 20-22 weeks.

Limited availability and costs of technology development have the influence on the price of such vehicles. Built-to-suit constructions are even two times more expensive than conventional diesel units, and the price can exceed EUR 200,000 (Table 7.7).

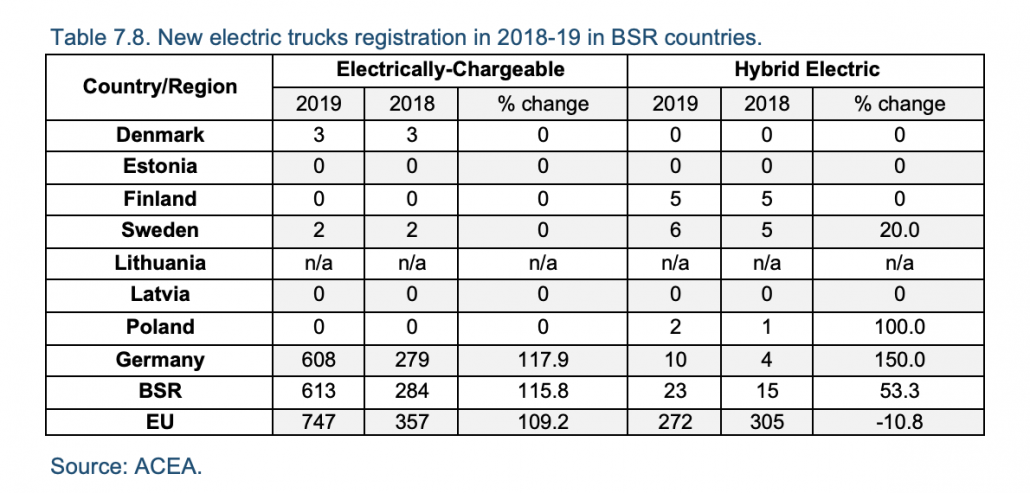

The number of projects which are developing electric trucks generates the influence on new trucks registrations in the EU. In 2019, there was registered 747 pure electric trucks, whereas 608 in Germany which is the leader of Electric trucks fleet in Europe. Comparing that to 2018, the number of electric trucks registered in the EU has risen by 109%, specifically in the BSR by 115% mainly due to the German market. The growth number of such vehicles in other BSR countries is marginal and is noticed only in Denmark and Sweden. Hybrid electric trucks are marginal in BSR trucks fleet and consist of 23 new registrations in 2019 which is 53% more comparing to 2018 y/y (Table 7.8).

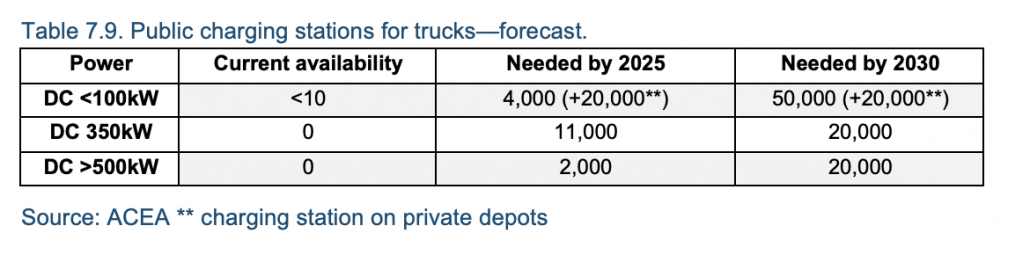

Some organizations provide estimates for the demand on public charging stations. What has to be noticed, the technical specification of chargers for trucks differs from those known from passenger cars. Because of their significantly higher power and energy demand, as well as the many parking spots required along all major routes in Europe, heavy duty trucks cannot use charging infrastructure for passenger cars.

Currently the network of charging points for trucks across EU actually does not exists. According to ACEA estimations, the need of public charging points for trucks till 2025 exceed 16,000 points. By 2030 this number might be even four times higher. Such a development of network requires financial support from local and European authorities. It is crucial for electric trucks fleet development to build stable efficient network of charging points (Table 7.9).

7.3.3 E-highway and hybrid trucks

The limitation of range due to battery capacity and the charging stations for e-trucks were one of the reasons to develop the project called e-highway. The project assumes to build on the motorways overhead power lines as the source of energy for trucks equipped in pantograph. The connection between truck and lines is arranged automatically in speed range up to 90 km/h. Road sections without the lines like internal roads in logistics centers or local streets can be covered using battery installed on board of truck. To improve the efficiency of the system, energy inverters installed on board can give back energy produced, i.e., during braking.

Based on available data, in 2020 there were only four sections of e-highway within the BSR, in Germany and Sweden. E-highway section in Sweden between Sandviken and Kungsgården has been built as the very first one and tested from 2016 till 2020. The plan for the nearest future is to close this project and evaluate the technology on first state e-highways planned on road E20 between Örebro and Hallsberg and Road 73 between Nynäshamn and Västerhaninge.

The three sections in Germany are developed during project ELISA which was started in 2018. In 2019 first section on A5 motorway in Frankfurt/Main area was ready to launch five test trucks. On A1 motorway in Lübeck area first trucks started tests in December 2019. Tests will take place until 2022, to collect the data under differentiated transport environment. First tests on the third section – on state road in Baden-Württemberg will take place probably in 2020 (Anon., 2020).

For ELISA project the exclusive truck manufacturer is Scania. The Swedish manufacturer expects to provide 15 trucks (5 for each test fields). As the project is on early stages and only few trucks have been delivered so far, it is hard to indicate the market availability of vehicles suitable for e-Highway.

An interesting option seems to be retrofitting old trucks with combustion engines into e-Highway suitable vehicles. The process includes changing the combustion engine to electric one with full equipment as inverters, batteries, and pantographs. It is also a good solution for the rising number of trucks which are not comply to latest Euro emission standards. A similar retrofitting has been arranged within the scope of project Trolley, where diesel buses were converted to trolleybuses (Anon., 2014).

The costs of developing e-Highway on A5 in Germany is estimated on ca. EUR 15,000,000 which means that each kilometer of infrastructure costs EUR 1.5 million. A5 motorway in Germany bears average load of 135,000 cars per day. Approx. 10% of them are heavy haulage trucks (Anon., 2020).

At the beginning of 2021 Siemens Mobility notified to plan the electrification of A15 motorway in the Netherlands; 50km section between Maasvlakte and Ridderkerk in Rotterdam port is a main way for heavy traffic flow through the port of Rotterdam. A huge part of this traffic is connected with the CT last mile operations and inside-port ILU shunting, as most of the container and ro-ro terminals in Rotterdam are located nearby A15 motorway. The first estimations provided by Siemens shows the electrification cost of EUR 2.5 million per each km of motorway. If the project will be launched, it can become a good benchmark for BSR LM operations market.

The above-mentioned examples and estimations shows that e-highway as a solution for CT last mile operations can be economic efficient only for the crowded transport nodes like ports or airports.

E-highway requires a close cooperation not only between infrastructure manager, power supplier and financing party. Every infrastructure has their users, here trucking or forwarding companies. What has to be noticed, transport services market in Poland or the Baltic States is fragmented. The trucking companies own on average few trucks which are universal, suitable for many destinations or types of cargo. Thus, projects such as e-Highway will require additional investment on vehicles, to be conducted by stakeholders like freight forwarders, 3PL companies or terminal operators. Further development of this kind of technologies may lead to trucking company’s consolidation, to concentrate the assets on specific part of the market.

The market of hybrid trucks for CT operations is actually limited to diesel tractor units with electric engines to support the transport in urban areas. This solution is provided by Paccar (DAF) in CF trucks as an alternative to short distance pure electric. CF hybrid is propelled with diesel truck on standard roads and highways. In urban areas truck can be switched into electric propulsion with max range 30-50 km. Thanks to the fast charging, batteries can be filled up in 0.5 hours, time that can be used for example during stripping or stuffing ILUs.

7.3.4 Fuel cells—hydrogen

Trucks propelled with hydrogen are actually vehicles with installed electric engine propelled with fuel cells. These cells need the hydrogen to generate the energy, so the H2 is considered as the fuel.

Hydrogen heavy duty vehicles market in Europe is in its early stages now. Scania tests their trucks with Cummins cells in Norway for local distribution. Volvo and Daimler (Mercedes) started the cooperation to develop the hydrogen fueled trucks.

At the most advanced level seems to be Hyundai. Its Xcient H2 truck was nominated for Truck Innovation Award 2020, and Korean manufacturer started to deliver the truck to first customers in Switzerland. The truck with 34.5 kg of H2 on board can reach total gross mass of 34 tonnes and keep 400 km range between fueling. Unfortunately, based on current data, Hyundai offers only rigid trucks configuration for hydrogen fuel, not tractor units needed got CT operations. This means that hydrogen, similar as electric trucks can be of the nearest future of CT last mile operations. For now, trucks suitable for last mile operations propelled by H2 are not available on the market.

Not any single hydrogen truck will work without efficient fueling network. ACEA calculates, that in 2020 there were 16 H2 fueling stations across Europe. Future development of technology will require the dynamic development of fueling points. Referring to ACEA estimations in 2030 Europe will need at least 500 H2 fueling points.

7.3.5 Summary and recommendations

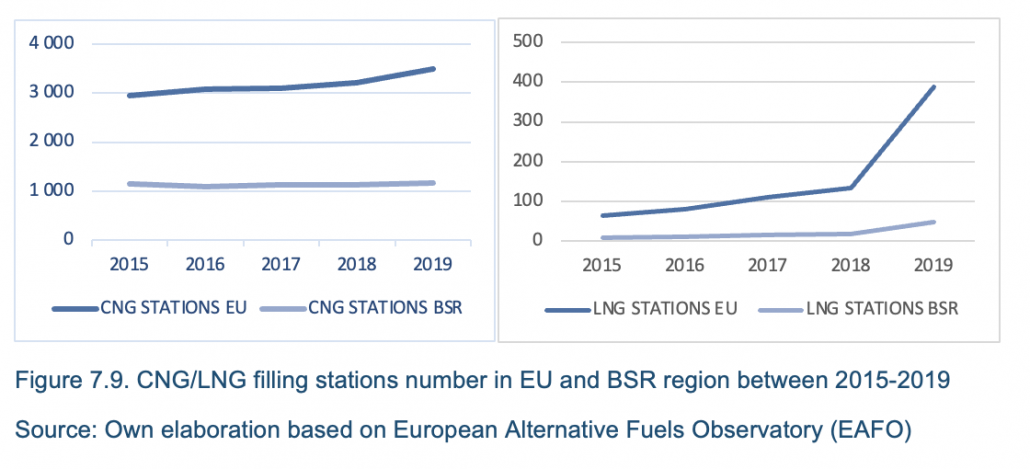

The nearest future of propulsion for last mile deliveries is closely connected with EU policy to decrease CO2emissions in heavy haulage transport. EU policy expects to obtain zero-emission economy until 2050. This requires from truck manufacturers to develop wide range of zero-emission trucks fleet. The group of leading European truck manufacturers declared to develop and sale only fossil free trucks by 2040. After 2025 and launching Euro 7 emission standard is expected dynamic drop of diesel trucks in total share of European fleet. The exact details of planned Euro 7 standards are still under preparation, but it is expected that the levels will be hard to achieve by conventional diesel trucks.

Most of the propulsions are now under research or testing process so its availability on the market is limited. The most available technology for now are NGV trucks which are widely available on the market. The total share of NGV vehicles should rise constantly up to 2025 whereas Euro 7 emission standard might get into force. After that, LNG or LBG trucks will be phased out of the market.

The technology of pure electric vehicles is developing dynamic. Manufacturers are capable to provide pure electric trucks with range and power suitable for CT operations. For now, those trucks are pure custom, built-to-suit work, so the price is for now the main limitation to the development. As soon as the technology will get in commercial serial production, the availability and the price should improve significantly. In the nearest future, the proper network of charging stations has to be considered as the must for this technology Hybrid trucks for CT operations should be considered more as transitional solution towards pure electric plug-in trucks. E-highway as a cost-intensive solution will remain in use for long haul trucking, and might not play a significant role in CT operations.

The third propulsion which can be considered as a solution for last mile CT operation is the hydrogen, which its constant development will transform from last mile city logistics to heavy trucking used for CT operations.

Taking into consideration transport decarbonization process all the stakeholders involved in the CT last mile should consider relevant action plans. Obviously the biggest challenge is in front of the trucking companies. Fleet lifecycle is considered for 4-6 years period, so most probably it is the last moment to invest in Euro 6 vehicles to fully utilize it before Euro 7 comes into force. After that, trucking companies will require government support or big financial reserves to upgrade the fleets to the new standards. The European standards are the first issue. The second, maybe even a more important are the heavy traffic limitations in the cities. The biggest cities in Europe already launched some restrictions of such traffic. It is connected with the emission from diesel trucks (Berlin) or with the safety of bikers and pedestrians in the blind spots (London). It can be expected that similar limitations may affect other cities causing costs for trucking companies.

New propulsion standards for CT last mile operations will have the impact on CT terminal owners or operators. To provide electrified last mile for customers require creating proper charging stations network in the nearest surroundings of terminal. Before that, fueling stations for NGV will become a must for some CT facilities.

Finally, new propulsions and fuels will affect the government, municipalities and road infrastructure administrators. Increasing number of electric vehicles should oblige the governments in all counties to adapt the legal regulations. Those should cover the increasing maximum permitted gross mass for electric vehicles to avoid lowering the capacity of the trucks due to batteries installed on board. The proper network of fueling and charging points cannot be limited to CT facilities. It should include also parking and rest points in the motorway infrastructure which belongs to road administrators.

All above analyzed trends and processes can be summarized in form of a roadmap (Figure 7.12), where specific trends can be observed in a long-term line, where the end-point is the 2050 zero-emission economy declared in the New Green Deal. It can be predicted that two energy sources will be the core propulsion for the whole transport sector, namely electric power and liquefied hydrogen (i.e., fuel cells).